ජාත්යන්තර මුල්ය අරමුදල සමග ඇති කරගත් ගිවිසුම යථාර්ථවාදීද? | April 02, 2023

FULL VIDEO: https://www.facebook.com/nationalmovementforsocialjustice/videos/683395686888859

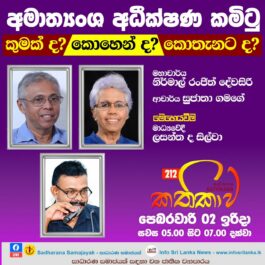

MODERATED BY: Prof Rohan Samarjiva

PANEL:

Dr. W. A. Wijewardena, Depuy Governor (Former), Central

Dr. Thilina Panduwawala, Head, Economic Research, Frontier Research

SUMMARY OF DISCUSSION

The first step out of the unprecedented crisis that Sri Lanka is experiencing has been taken in the form of a 48-month extended fund facility negotiated by the government of Sri Lanka and the IMF. The actions and targets set out in the 151-page document are ambitious. For example, the government (GOSL), which has achieved a primary balance surplus on only five occasions since independence, has committed to achieve a surplus primary on 2.3 percent by 2025. This, in a country with one of the lowest taxation ratios in the world. Because there is a limit on what can be done on the revenue side in an economy mired in crisis, this would most likely require extraordinary discipline in state spending and perhaps even a radical reduction in the size of the state. However, it appears that even after all this the expected growth rate will below the average since independence.

To achieve economic growth higher than envisaged in the IMF report will require concerted action beyond what is included in the IMF program such as the attraction of higher levels of foreign investment in the tradable sector and integration into global production networks.

Can the Sri Lankan state achieve these hard things? Will it be possible to stay the course?

Conclusions and Recommendations

- The IMF program will not be adequate by itself. The government must give priority to actions that will result in diversification of exports into high-value sectors by seeking greater integration into global production networks.

- The potential of integrating into India centric supply chains must be explored in detail.

- Attention must be paid to different possible outcomes. The multiple variables at play will result in significant differences in the possible paths the economy will take.

- Delays such as the failure to complete the verification of the social safety net registry can lead to inability to meet the target for social welfare disbursements and as a result a failure to meet quantitative performance criteria.

- Revenue collection mechanisms in government must be made more efficient and the capacity of IRD officials improved.

- Major enhancements in surveillance by IRD is necessary to improve tax collection.

- The financing gap projections appear to rest on significant concessions from Sri Lanka’s creditors. Some form of domestic debt restructuring (described using different terms) is likely.

- Sri Lanka’s negotiations to debt restructuring may not succeed, as has been the case in Surinam and Zambia.

- A more conciliatory approach to groups opposing various measures associated with the IMF program is necessary to avoid IMF riots.

- Given the minimum required to meet living costs, government may reconsider the threshold for taxation.